If you are looking to sell your home "For Sales By Owner", then you may be interested in the buyer agent commission. This can be a tricky question because the actual commission you will pay can vary widely. The general rule is that you will pay a percentage on the selling price of your home. The commission typically amounts to five to six percent.

Before making a decision on your commission you must ensure that you are familiar with the terms and conditions of your listing agreement. The seller's broker usually pays the commission, which is then divided with the buyer's agents. Some agents may receive more than one split.

It is important to think about the benefits of using an agent buyer. A buyer's representative can help you to sell your home and show you the latest properties in your market. A buyer's agent can also help you through the closing process. They can arrange for termite inspections. They may even be able to negotiate on your behalf.

If you decide to use a real estate agent, make sure to read up on the advantages of working with a professional. You want to be sure you're working with a reputable and experienced real estate professional who can guide you through the buying and selling process. Many agents have the ability to access financial and legal experts to assist them in negotiating and dealing with the title company.

You might get advice from your real estate agent on how you can save money on a buyer’s agent commission. A flat fee is an option for you to list your property with an agent. This will save you half of the commission. You can also find out the value of individual real estate services within your locality.

The commission your agent receives can vary depending on where you live. In fact, some cities have laws that require sellers to pay their buyer's agent at least 1%. A lower rate is available in other areas such as Westchester County. Still, if your broker gives you a good deal, you can't complain.

Even if an agent is available, you should still conduct a thorough assessment of the value of your property. Your location, competition and quality of your marketing will all play a role in determining whether you get the best price for the home. For a title search and appraisal of your property, a local realty lawyer can help you get the best deal.

In order to obtain financing, buyer's agents can be very helpful. Although lenders don't usually allow home buyers to pay termite inspections, a real agent can make arrangements. Besides, a buyer's agent can provide a variety of other valuable services, such as doing a market analysis.

Remember that a buyer's agency commission cannot be cancelled after you have signed a purchase contract. The good news is that you don't need to pay commission if you find a buyer who is actually interested in buying your house.

FAQ

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

What's the time frame to get a loan approved?

It depends on several factors such as credit score, income level, type of loan, etc. It usually takes between 30 and 60 days to get approved for a mortgage.

How much money do I need to save before buying a home?

It depends on how much time you intend to stay there. You should start saving now if you plan to stay at least five years. But if you are planning to move after just two years, then you don't have to worry too much about it.

How do you calculate your interest rate?

Market conditions can affect how interest rates change each day. In the last week, the average interest rate was 4.39%. Add the number of years that you plan to finance to get your interest rates. If you finance $200,000 for 20 years at 5% annually, your interest rate would be 0.05 x 20 1.1%. This equals ten basis point.

What are the top three factors in buying a home?

The three most important things when buying any kind of home are size, price, or location. Location refers to where you want to live. The price refers to the amount you are willing to pay for the property. Size refers to how much space you need.

What are the chances of me getting a second mortgage.

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

Statistics

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

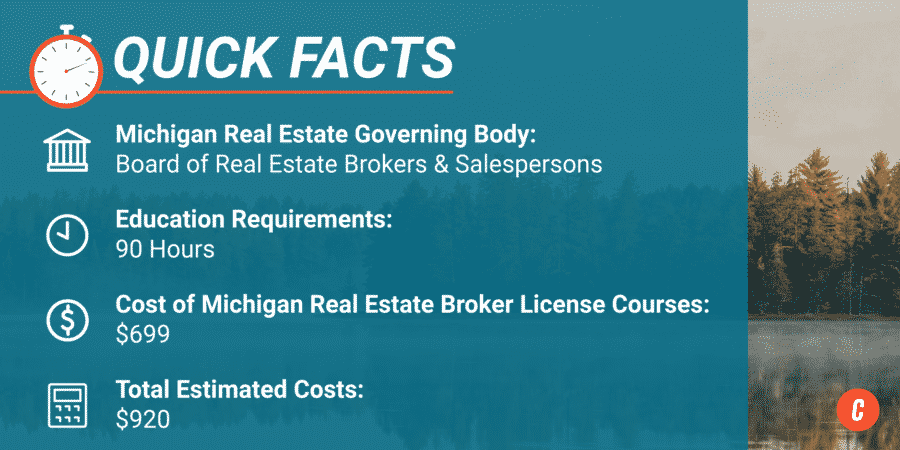

How to become a real estate broker

You must first take an introductory course to become a licensed real estate agent.

Next you must pass a qualifying exam to test your knowledge. This requires that you study for at most 2 hours per days over 3 months.

This is the last step before you can take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

You are now eligible to work as a real-estate agent if you have passed all of these exams!