Rent to Own

A rent-to-own agreement is a great option to buy a home without having to pay too much. This type arrangement can help you build equity. Rent-to-own agreements can have risks so make sure you do your research before signing one. Do your research on the contract, the home, and the seller.

Hard money loans

If you want to invest in real estate, but you don't have enough money to purchase property outright, one option to obtain the funds you need is to use a hard money loan. These loans enable you to purchase property, usually without the need for any cash upfront. Although they are costly, these loans offer quick access to money. Within a few days, you can close the loan and get started on your investment property.

House hacking

House hacking can be a good strategy for those who don't want to spend the cash necessary to purchase property. This type of strategy allows you to buy a home with a low down payment. Then, you can use your down payments savings to pay for other expenses. In addition, this method doesn't require you to build equity and it's ideal for first-time home buyers.

Spending money from other people

You can use other people's money to buy real estate. This is a great method to reduce risk while increasing your returns. It is important to manage other people's money well.

Investing via REITs

REITs can be a great way for you to invest in real property without spending any money. You can diversify your portfolio with REITs by purchasing a variety property types. You also get passive income and dividends. With the right REIT you can invest as little $100. Automated investing and dollar cost averaging can be set up.

Crowdfunding

Crowdfunding is an excellent option for those who don't have much money but still wish to invest real estate. Real estate crowdfunding platforms allow you to pool your money with other investors to make investments. Real estate investment trusts (REITs) are one type of such investments. They own multiple income-generating real properties. These investments are a more straightforward way to build wealth with a smaller amount of money than many other investment methods. REITs can either be publicly traded or privately trade. Reits that are publicly traded offer greater dividends than other stocks.

FAQ

What should I look for in a mortgage broker?

A mortgage broker helps people who don't qualify for traditional mortgages. They compare deals from different lenders in order to find the best deal for their clients. This service is offered by some brokers at a charge. Others offer no cost services.

How long does it take to sell my home?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It takes anywhere from 7 days to 90 days or longer, depending on these factors.

What are the benefits to a fixed-rate mortgage

A fixed-rate mortgage locks in your interest rate for the term of the loan. This guarantees that your interest rate will not rise. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

What are the key factors to consider when you invest in real estate?

The first thing to do is ensure you have enough money to invest in real estate. You will need to borrow money from a bank if you don’t have enough cash. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

You should also know how much you are allowed to spend each month on investment properties. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Also, make sure that you have a safe area to invest in property. It is best to live elsewhere while you look at properties.

What is a reverse mortgage?

Reverse mortgages allow you to borrow money without having to place any equity in your property. It works by allowing you to draw down funds from your home equity while still living there. There are two types of reverse mortgages: the government-insured FHA and the conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. If you choose FHA insurance, the repayment is covered by the federal government.

What are the three most important factors when buying a house?

The three main factors in any home purchase are location, price, size. Location refers to where you want to live. Price is the price you're willing pay for the property. Size refers the area you need.

Should I buy or rent a condo in the city?

Renting might be an option if your condo is only for a brief period. Renting lets you save on maintenance fees as well as other monthly fees. However, purchasing a condo grants you ownership rights to the unit. The space can be used as you wish.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

External Links

How To

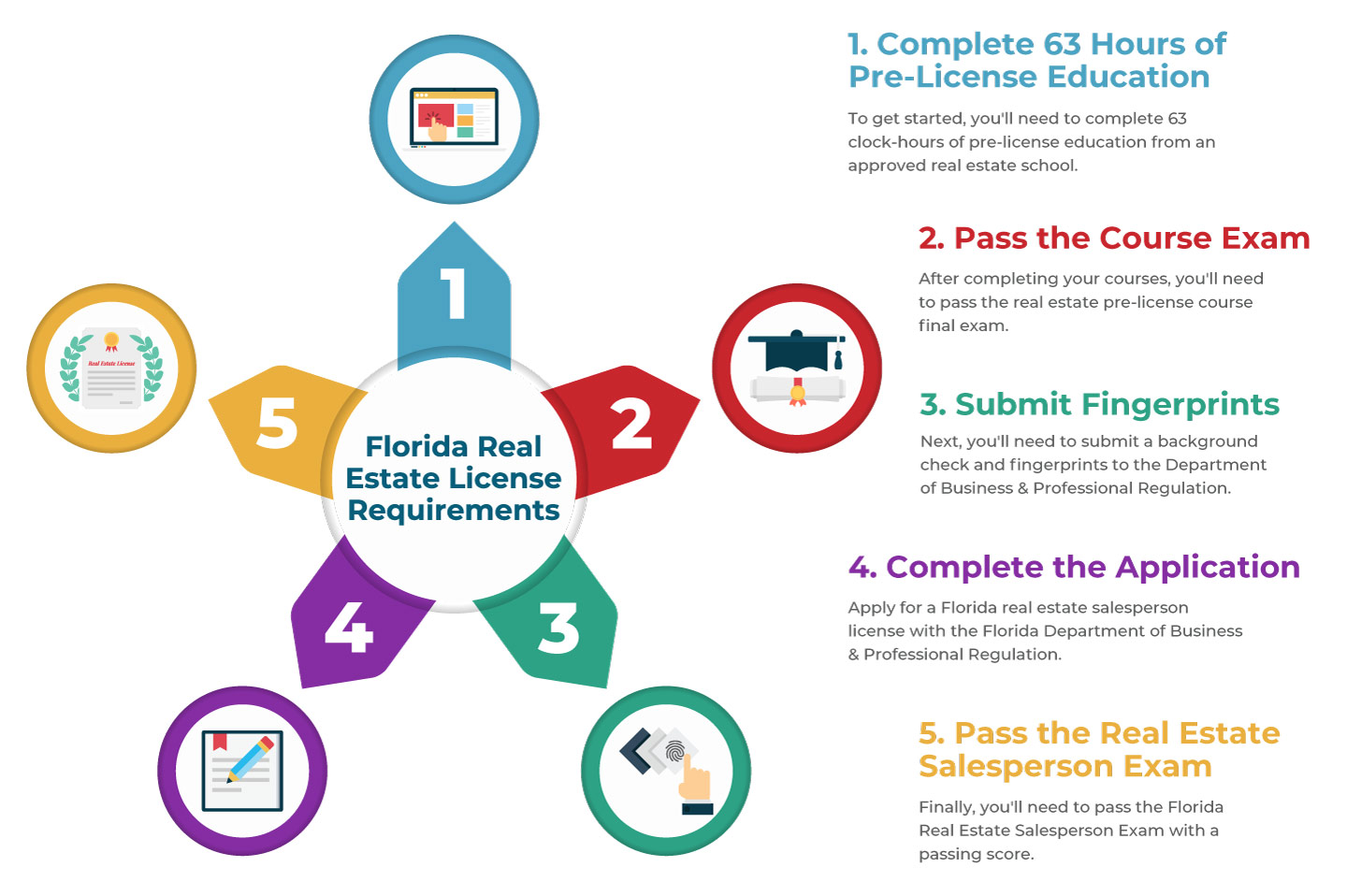

How to become an agent in real estate

The first step in becoming a real estate agent is to attend an introductory course where you learn everything there is to know about the industry.

The next step is to pass a qualifying examination that tests your knowledge. This requires you to study for at least two hours per day for a period of three months.

You are now ready to take your final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!