Brokerage real estate fees are the fees charged to brokers by clients who want them to represent them in transactions, such as purchasing and selling homes, renting apartments, or securing loans. They are often based on a percentage of the transaction, a flat fee, or a hybrid of the two.

Brokers Commission - What is it?

A real estate agent receives a commission as a payment for his or her services. It is a fee that represents the value of their expertise and the professional services they provide to clients in real estate sales and leases. This is usually a percentage of a sale price that can be divided between agents.

It is common in the real-estate industry. However, it can also be found in other industries like brokerage firms that offer financial services. It is usually either a flat rate or a fixed percentage. It's often negotiated by the client when they sign a contract with an agent.

What is the average broker fee?

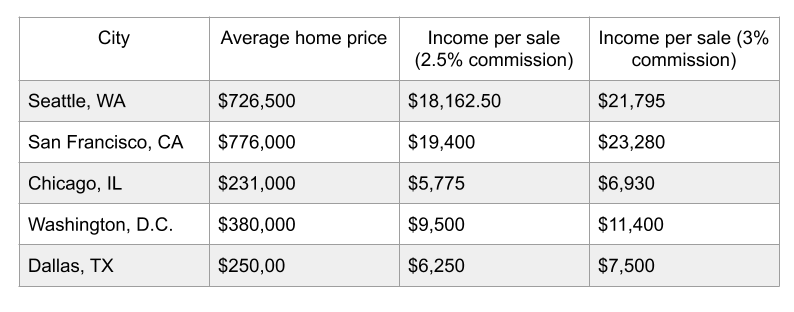

Brokerage costs can vary dramatically depending on an asset's type and value. For example, homes purchased for owner occupancy tend to have relatively low brokerage fees in terms of a percentage. However, fees on investment properties can be higher.

What are the advantages of working with a Broker?

By helping you find a new house, a real estate broker can save both time and cash. They can provide you with information about the current market conditions and what you can expect to spend in different areas. They will also guide you through the entire process, from identifying a property that fits your needs to closing on the purchase.

What are the possible risks when using a Broker?

A brokerage firm will offer insurance to protect their representatives in the event that they are sued for negligence. Errors & Omissions Insurance can be included, which protects the agent if he or she makes a mistake and misstates something to their client. It can also cover any legal fees if a claim is made against the agent.

Does the tenant need to pay for a broker's fee?

Understanding the broker fees rules is essential if your goal is to rent an apartment. It is important to understand whether the broker fees are paid by the landlord or the buyer.

Is it against the law to charge renters for a broker's fee?

Broker fees may be legal on the New York City market for rentals, but it has been a topic of controversy for quite some time. Both landlords and renters disagree on this practice. Several laws have been passed in an attempt to ban it.

It's always best to be aware of your options before you start looking for an apartment, and to do some research on the laws of your state. As a landlord, you should look for apartments that don't charge a brokerage fee and are regulated.

FAQ

Can I get a second mortgage?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

What should I do before I purchase a house in my area?

It all depends on how many years you plan to remain there. It is important to start saving as soon as you can if you intend to stay there for more than five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

How long does it take to sell my home?

It all depends upon many factors. These include the condition of the home, whether there are any similar homes on the market, the general demand for homes in the area, and the conditions of the local housing markets. It may take 7 days to 90 or more depending on these factors.

Should I buy or rent a condo in the city?

Renting is a great option if you are only planning to live in your condo for a short time. Renting will allow you to avoid the monthly maintenance fees and other charges. On the other hand, buying a condo gives you ownership rights to the unit. The space can be used as you wish.

What are the downsides to a fixed-rate loan?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

How can I get rid Termites & Other Pests?

Termites and other pests will eat away at your home over time. They can cause serious damage to wood structures like decks or furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

What are the pros and cons of a fixed-rate loan?

With a fixed-rate mortgage, you lock in the interest rate for the life of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans come with lower payments as they are locked in for a specified term.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to Find Real Estate Agents

The real estate agent plays a crucial role in the market. They sell homes and properties, provide property management services, and offer legal advice. The best real estate agent will have experience in the field, knowledge of your area, and good communication skills. Look online reviews to find qualified professionals and ask family members for recommendations. It may also make sense to hire a local realtor that specializes in your particular needs.

Realtors work with homeowners and property sellers. It is the job of a realtor to help clients sell or buy their home. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. Most agents charge a commission fee based upon the sale price. However, some realtors don't charge a fee unless the transaction closes.

The National Association of Realtors(r), or NAR, offers several types of agents. NAR requires licensed realtors to pass a test. A course must be completed and a test taken to become certified realtors. NAR has set standards for professionals who are accredited as realtors.