Certain requirements are required if your goal is to become licensed in Tennessee as a real estate agent. Prelicense and real estate exams must be passed. Before you register for an Exam, it is essential that you fully understand the requirements. Additionally, you will need to have real estate experience.

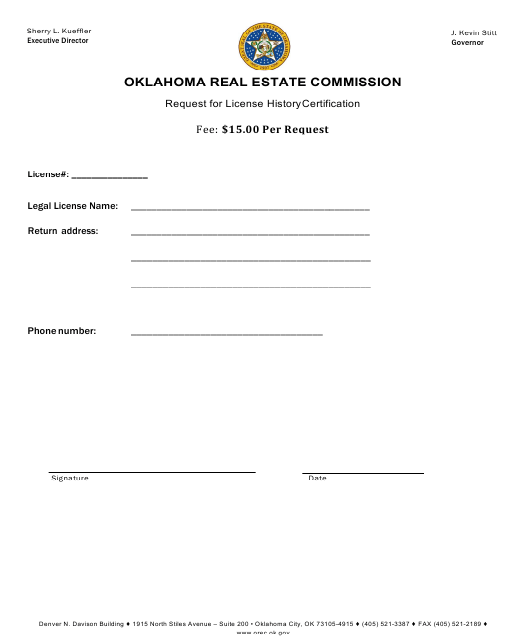

Tennessee real estate commission

If you want to become a real estate agent in Tennessee, there are a few steps you can take to get the license you need. First, you must pass a background exam. This can be done by sending fingerprints to the FBI or TBI. When you submit your fingerprints, please use the service code28TZ99 along with the OIR Number TN920784Z. The fee is $35.

Tennessee requires that real estate brokers and affiliates complete 16 hours of continuing education each year. To earn these hours, you can take the TREC Core Course, a six-hour course. Failing to complete the Core Course will prevent you from renewing your license. A pre-license course, or an online course, can increase the number of hours you have. You must apply to your state license within six months after passing the exam.

Prelicense course

Prelicense classes are necessary to get a Tennessee real-estate license. To obtain your license, you will need to take prelicense classes. You can find them online. You must be at the least 18 years old and possess a high school diploma to become a Tennessee real estate agent. Additionally, you must complete a sixty-hour course called Basic Principles of Real Estate before taking the state exam. An affiliate broker can also receive Errors Insurance. This insurance protects you from unintentional mistakes and lawsuits.

A real estate business course can give you valuable insight into the industry's legal aspects and provide valuable insight. You will also learn about fair housing, public protection and other laws. Additionally, you will learn how to negotiate and close transactions. Additionally, you'll learn Tennessee law and prepare for the exam.

Exam

If you are looking to become a real estate agent in Tennessee, you're probably wondering how to get your license. The state of Tennessee requires real estate license applicants to take a test to prove their knowledge. To be eligible to take the exam, applicants must submit a list including a highschool diploma (or equivalent), proof of 90 hours real estate school and proof insurance for errors and/or omissions. The fee to become a real estate agent in Tennessee is $700. Afterward, you'll need to renew your license every two years. You'll also need to take at least 90 hours of real estate courses, which you can do through online classes such as Aceable Agent.

There are two parts to the Tennessee exam that will allow you to become a licensed real estate agent. The national portion has approximately 160 multiple choice questions. The state-specific portion includes five to ten experiment questions. The test takes about 80 minutes and requires you to answer 56 correct responses on the national and 28 on the state-specific portions.

License requirements

There are certain education requirements and experience requirements to become a Tennessee real-estate broker. First, you need to have a baccalaureate degree with a major in real estate. Then, you need to complete 120 hours of real estate-related coursework, which includes an Office and Brokerage Management Course. You will also need to complete continuing education standards. This includes the TREC Core Class.

After passing the examination you will have to submit documentation the Tennessee Real Estate Commission. You will need to provide documentation to support your education and experience after passing the exam. If your license has been suspended for more than one calendar year, you must take the exam over again. You can however renew your license if it has been expired for less time than a year by paying the appropriate fees.

FAQ

How much money do I need to purchase my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. According to Zillow.com, the average home selling price in the US is $203,000 This

How do I calculate my interest rates?

Market conditions affect the rate of interest. The average interest rates for the last week were 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

What are the benefits to a fixed-rate mortgage

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. You won't need to worry about rising interest rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

How to buy a mobile house

Mobile homes can be described as houses on wheels that are towed behind one or several vehicles. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. Today, mobile homes are also used by people who want to live out of town. These houses come in many sizes and styles. Some houses are small while others can hold multiple families. Even some are small enough to be used for pets!

There are two main types for mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This occurs before delivery to customers. The other option is to construct your own mobile home. It is up to you to decide the size and whether or not it will have electricity, plumbing, or a stove. You will need to make sure you have the right materials for building the house. Final, you'll need permits to construct your new home.

You should consider these three points when you are looking for a mobile residence. Because you won't always be able to access a garage, you might consider choosing a model with more space. If you are looking to move into your home quickly, you may want to choose a model that has a greater living area. Third, you'll probably want to check the condition of the trailer itself. Damaged frames can cause problems in the future.

Before you decide to buy a mobile-home, it is important that you know what your budget is. It's important to compare prices among various manufacturers and models. You should also consider the condition of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

An alternative to buying a mobile residence is renting one. Renting allows for you to test drive the model without having to commit. Renting is expensive. The average renter pays around $300 per monthly.